Introduction

We discuss the modest beginnings of digital in this guide.

teach you the basics of bitcoin and highlight currencies.

The main benefits of bitcoin over fiat currencies.

Introduction to Digital Currency

What is Digital Currency?

Digital currencies are decentralized means of exchange

that are made to reflect a position on a ledger system and kept in digital format. This contrasts with conventional Metal coins or paper dollars are examples of currencies that may be used.

be kept in physical custody and released with particular support

governments.

Digital Currency Origins

Even if digital currencies are becoming more widely accepted (mostly because of the

Despite the recent rise in popularity of bitcoins, the concept of digital monetary systems can be traced back to the early 1990s.

At that time, the Internet was a relatively new concept that the general public was still trying to understand.

head around (like Bitcoin is now).

Numerous programmers and businesses attempted to manufacture cash with the intention of being exchanged.

Electronically, in the 1990s and early 2000s, like with Flooz and DigiCash. A lot of these Due to inadequate technology and inadequate security, early currencies had trouble being adopted.

funding shortages, features, and a host of other problems. However, bits of their technology Additionally, modern digital currencies continue to incorporate novel concepts.

Bitcoin Basics

Despite the currency’s recent surge in popularity, Bitcoin is still a niche market. The concept and technology underlying the currency, which is a household name has been around since 2009. Bitcoin was developed by a software developer,

or team of coders calling themselves Satoshi Nakamoto. No one has ever come forward, either alone or in a group.

identified or asserting ownership of the Bitcoin code’s creation

themselves as Nakamoto. The paper that first described the

Bitcoin is a peer-to-peer electronic payment method.

The digital currency system was described by Nakamoto as follows:

A version of that is entirely peer-to-peer

digital money that would enable online payments to be sent directly from one party to another without through a bank.

How Does Bitcoin Work?

Bitcoins may be used by people to pay other people.

people or businesses without the involvement of a third party, such as a bank or other financial organization for validation.

Rather, transactions are validated and cleared within the

the blockchain system.

What is the Blockchain?

The blockchain is a shared, open ledger that documents and publishes information about transactions.

lists every bitcoin transaction that has been completed.

within the Bitcoin network. A block is a permanent record of

transactions that occurred lately. The recorded data is organized into blocks.

in order to create the blockchain, which goes all the way back to its origins.

Returning to the initial bitcoin transaction.

Transparency is crucial and is facilitated by the blockchain.

in ensuring the validity procedure because it gives the community

to keep an eye on and self-regulate transaction activity. It also allows for confirming the identities of both the payer and the payee, and makes it impossible to spend a bitcoin twice. We will

In upcoming articles, we will go into more detail about the blockchain.

How Do I Get Bitcoins?

Understanding the Bitcoin system and acquiring bitcoins isa somewhat straightforward procedure.The four essential methods of getting bitcoins entails:

Transactions

People and retailers have the option of choosing

get paid in bitcoins for items as well as peer-to-peer or provided services transfers of funds.

Digital Currency Exchanges

A digital currency exchange functions in a

like conventional fiat money exchanges where people may buy and sell.

market bitcoins at the going rate.

Bitcoins have a variable exchange rate.

depending on demand, liquidity, and several other criteria

market circumstances.

Mining

The foundation of Bitcoin is made up of miners.the environment. They are compensated financially.in bitcoin for the services they offer for the network, such as addressing the algorithms required for processing deals that contribute to safeguarding the maintain the network and make sure it functions properly.

Bitcoin ATMs

Bitcoin ATMs are growing in popularity.

a method to acquire the cryptocurrency because they are easy to use and convenient.

Using a bitcoin ATM to conduct a transaction is quite simple. First, ATM users check by using a QR code to scan their bitcoin wallet on their smartphone. Then, they put money in.

put it in the ATM and submit to finish the transaction. The correct sum of The bitcoins are subsequently sent to their wallet.

considering the exchange rate right now.

An Investor Guide To Crypto Currency

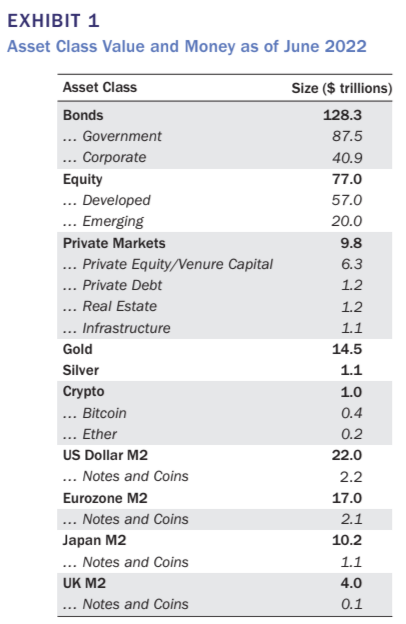

NOTES: The trillions of exceptional notional are on display in this exhibit.

consisting of cryptocurrencies and traditional asset classes denominated in US dollars.

The following sources are used to collect the data. Bonds: Interna equivalent in US dollars, International Capital Market Association (ICMA) imagined outstanding. Equity—MSCI, the entire free-floating market Bloomberg provides the data for capitalisation. private markets— Annual McKinsey review of private markets for 2022. Gold and silver According to the United States Geological Survey (USGS), ver is:

The World Gold Council is headquartered at 244,000 and 1.7 million metric tons.

tons found, and current prices for gold are $1,716/oz.

CoinMarketCap is a cryptocurrency website. Silver costs $18 an ounce. Regular for-Central banks in the appropriate jurisdiction regulate foreign exchange (FX). (US Federal Reserve)

European Central Bank (ECB), Reserve Board, Bank of Japan

(BoJ) and Bank of England (BoE). We convert to US dollars.

utilizing exchange rates based on the 12-month average exchange rate measured in July 2022. The information is current as of June 30, 2022.

Any investment must begin with a thorough understanding of the facts.

Understand what you’re investing in. Despite the attention that bitcoin receives,It receives the most media coverage, but it only accounts for a little over half.

regarding the value of this novel environment for cryptocurrency assets. In fact,The functionality of varies greatly.

price drivers and blockchains for cryptocurrencies.

Unlike bitcoin, Ethereum allows for what is known as

the standard for developing feature tokens and smart contracts

dards1

that assist in the development and implementation of initiatives and tokens on top of their blockchain.

2

These tokens can facilitate

particular functions, like paying for delivery

representing ownership of digital art or storing data

through the use of nonfungible tokens (NFTs). There are also tokens.

which are connected to decentralized exchanges as well as

Lending and savings regulations. Additionally, there is

an increasing market for stablecoins, which are tokens connected to a a hard currency like the US dollar. The area is

more and more diverse.

3

An investor has a wide range of options.

gain exposure to cryptocurrencies. The easiest way to do this is to maybe The ward is through futures contracts or other assets.

like exchange-traded funds (ETFs). Investors may

Additionally, pay the with a VC fund that is focused on cryptocurrency.

costs related to the VC investment. It is also possible to

Additionally, it is possible to purchase the actual coins. Investors may also deploy stablecoins that are supported by collateral

towards proto-centralized and earn a return for providing liquidity—some—similar to a high-risk investment in fixed income.

We start by analyzing the different methods.

used to determine the worth of cryptocurrencies. None of these

1 The typical interface for fungible tokens, for instance, is ERC-20.

(interchangeable) tokens, such as voting tokens or staking tokens, or bitcoin and ether are examples of virtual currencies. The standard for virtual currencies is ERC-721.

NFTs have a pain interface similar to the deed for a piece of art or a song.

Other standards include ERC-777 and ERC-1155. Look at

- The Bitcoin and Ethereum blockchains are referred to as Layer 1.

block chains. Numerous other Layer 1 chains, like Solana, exist.

and Algorand. 3 There are numerous subcategories within the crypto space. This is where they are:

Examples include the ones listed in parentheses, which are a few examples of cryptos.

protocols, businesses, and cryptocurrencies. (1) Layer 1 coins (for example,

(1) Bitcoin, ether; (2) DeFi (Uniswap, Compound, Maker Dao, dYdX); (3)

(3) NFTs (OpenSea, LooksRare); (4) gaming (Sky Mavis); (5) Metaverse

(Decentraland, Sandbox); (6) Layer 2 (Starkware, Optimism); (7) privacy (Keep, Aztec); (8) institutional

(9) financial services (Blockfi, MoonPay, Bitgo, Circle); (10) infrastructure services (Coinbase Pro, Fireblocks); and (11) legal assistance (Bitgo, Circle).

(11) trading and exchange (FTX, Coinbase, Binance); (12) data; and (12) data (Blockstream, Chainlink, Consensys).

Messari, Dune Analytics, and Chainalysis are examples of analytics firms. (13) Mining includes mining companies (TeraWulf,

(14) Web3 (Skynet, Helium, Protocol); (13) Lending (Genesis, NYDIG), hardware (Bitmain, Bitfury), and Hive.

(15) social networks (DeSo); (16) research and development (OpenZeppelin, Shard Labs); (17) labs;

(18) security (Gauntlet, Forta); (19) identity (Spruce); and (20) cross-browser/wallets (Argent, Opera).

chain bridges (Wormhole), as well as decentralized autonomous organizations (DAOs) and other structures.

the creator economy (which includes decentralized music and video). Algorithmic stablecoins are not included among collateralized stablecoins. The following are examples of collateralized stablecoins:

crypto overcollateralized like MakerDAO’s DAI, RAI, and fiat collateralized like USDC and USDT

While algorithmic stablecoins depend on a dynamic money supply regulation to aid in maintaining their stability, FEI does the opposite.

peg. Algorithmic stablecoins are risky and prone to bank runs for any undercollateralized asset.